BGV-01 - Bismuth Governance Vote 1

Preamble - This blog article explains the BGV-01 motion and the options you can vote for.

Preamble - This blog article explains the BGV-01 motion and the options you can vote for.

Abstract

- Motion: Keep Bismuth supply emission as it currently is (A) , or significantly reduce emission – therefore option (B).

- Voting period: From 2019-10-01 at 12h00 UTC to 2019-11-01 at 12h00 UTC (block time counts)

- Vote reveal: From 2019-11-01 at 12h00 UTC to 2019-11-10 at 12h00 UTC

- If a hardfork is decided, it could take place at block height 1,450,000, approximately on 2019-11-27

(draft timeline has been updated with final values)

Background

Changing the supply emission of Bismuth is not something to be taken lightly. There are many arguments in favor of both options. Hence, the members of the Bismuth Foundation have decided to make this decision the first community vote to be carried out. There will be two options to vote for:

A) Keep the status quo, ie. keep the emissions curve as it is currently programmed, or:

B) Modify the block rewards to significantly reduce the overall dilution.

Option A: BGV-01/A

Do not change the supply, keep emission like it currently is, see the supply post. With Option A the annual dilution per year measured in $BIS starting from block height 1,450,000 (2.5 years into the project) would be:

| Year | Percentage |

|---|---|

| Year 1 | 30.0% |

| Year 2 | 21.0% |

| Year 3 | 15.6% |

| Year 4 | 11.9% |

| Year 5 | 9.3% |

| Year 6 | 7.3% |

| Year 7 | 5.6% |

| Year 8 | 4.2% |

| Year 9 | 3.0% |

| Year 10 | 2.2% |

Option B: BGV-01/B

Radically change the supply emission from block 1,450,000 to lower the dilution and part of the market sell pressure.

Mining (PoW) Block rewards would be lowered from 9.7 to 5.5 (reduction of 43%), but the curve is then decreasing slower. Hypernodes (PoS) rewards would begin to decrease instead of being constant. Overall dilution would be reduced from 30.0% to 19.4%, and decrease up to a tail emission of 2% after 10 years. Long-term lower limits on the rewards have been introduced to give miners and Hypernode owners incentives to remain in the ecosystem. With Option B the annual inflation per year starting from block height 1,450,000 would be:

| Year | Percentage |

|---|---|

| Year 1 | 19.4% |

| Year 2 | 14.9% |

| Year 3 | 11.7% |

| Year 4 | 9.4% |

| Year 5 | 7.6% |

| Year 6 | 6.1% |

| Year 7 | 4.9% |

| Year 8 | 3.8% |

| Year 9 | 2.9% |

| Year 10 | 2.0% |

Implications:

- For holders: less dilution, one of the components of the sell pressure goes down.

- For Hypernodes owners: no immediate change in the rewards, but on the long run Hypernodes rewards will decrease.

- Still, because of the dilution drop, the Hypernodes yield in the beginning will be higher than the overall dilution rate.

- For miners: reduction of rewards short term, but more rewards after some time (block height 5,300,000).

- For dApps: no changes to fees or block times.

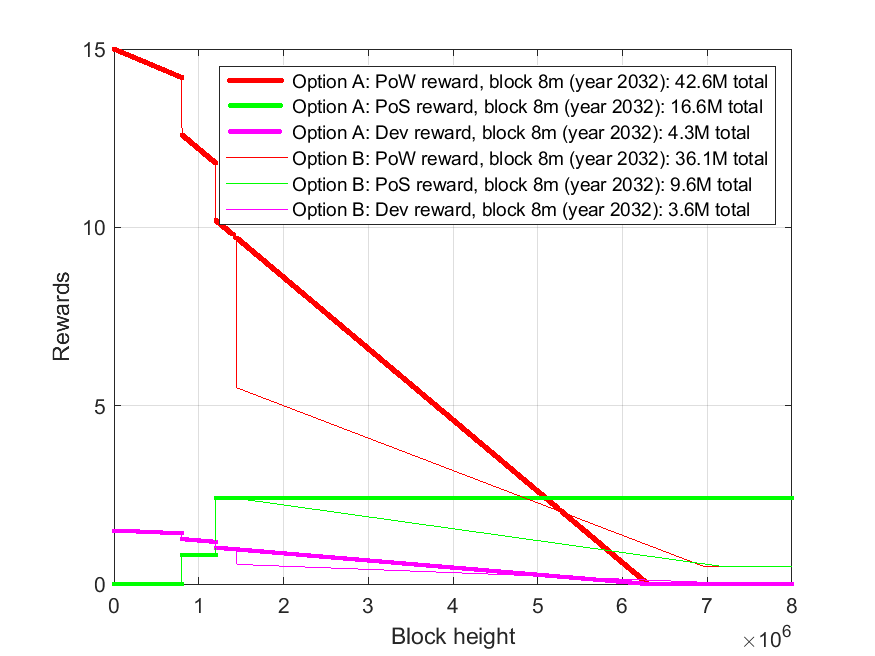

Graph: (A) vs (B)

The current emission curves (Option A) and the proposed modified curves (Option B) and the associated dilution rates are compared in the figure below: Current emission (A) is in Bold, emission for (B) is thinner.

Use of the winning funds

As described in the Bismuth voting protocol, the BIS of the losing side are sent back to their originating wallets, while funds of the winning side are kept in a fund to finance the option. For this motion the winning funds – whatever the issue will be – are to be used as exchange listing and dapps bounties funds.

Arguments

Arguments for option A:

- Cryptocurrencies are supposed to be different from fiat currencies, where central banks regularly adjust monetary policies. See for example this article, where one of the conclusions is: “… cryptocurrencies offer a unique opportunity to engineer long term monetary policy that is carried out in full transparency. Unfortunately, many protocols we’ve looked at do not take advantage of this opportunity, or are prone to change (which defeats the purpose).”

- Option B, although seemingly radical towards the miners (initial 43% reduction), shifts the emissions curve by approximately one year. The Bismuth Foundation has a long-term perspective, and one year means very little in the grand scheme.

- The miners play a very important role, by securing the chain with their hash power, and building it in the first place. The PoS chain wouldn’t exist without the PoW chain, and Bismuth is – at core – a PoW chain. By reducing the miners rewards (Option B) there is a high probability that the overall hash power will be reduced. With a reduced overall hash power in the network, the Bismuth blockchain will become more vulnerable to a 51% attack. Should such an attack occur, it is likely to be detrimental for the $BIS price.

- Bismuth is mainly a PoW coin, with no premine or ICO. It is meaningless to compare its supply model or dilution to pure PoS models, ICOs or premined coins.

- Supply is just one component of sell pressure. Holders selling when market goes down also play a significant role in sell pressure. Everyone’s time would be put to better use in building the demand side up rather than trying short term hacks with supply.

- Market could play a more important role than the supply curve. No need to play against the market, better wait for a purge and the next bull run.

- In order to reduce the dilution, option B requires the PoS rewards – part of the dilution – to decrease instead of being constant. This can be seen as a time bomb for Hypernode owners, unless use-cases based upon the Hypernodes do add new income sources to Hypernode owners.

- Option A would not require a hardfork, so there is less work for all the network participants (exchanges, pools, Hypernode owners) which all would have to update their nodes if Option B is selected.

Arguments for option B:

- By significantly reducing the miners block rewards – hence dilution – the staking yield for Hypernode owners will initially become net positive (larger than the dilution caused by new coins).

- By reducing the block rewards some believe that the supply reduction and increased scarcity will help recover the $BIS price, which has fallen significantly in recent times.

- If the $BIS price would increase by a factor 2x or more after the supply reduction, the miners would be better off measured in USD compared to before, since the miners’ rewards measured in $BIS will initially be reduced by a factor of less than 2x.

- Option B introduces a long-term lower limit of Hypernode rewards of 0.5 $BIS per block to ensure that the block rewards can never reach zero, meaning the Hypernode owners have an incentive to stay in the ecosystem, in case future fees from use-cases are not sufficient or too irregular.

- Option B introduces a long-term lower limit of the miners reward of 0.5 $BIS per block to ensure that the block rewards can never reach zero, meaning that the hash power will not disappear in case future network fees are not sufficient or too irregular to reward the miners.

- With Option B the developer rewards do not go to zero either, but have a lower limit of 0.05 $BIS per block (10% of the miners block rewards), giving the core team a long-term incentive to keep working on and improving the blockchain, it’s ecosystem, as well as a marketing and exchange listing budget.

- Many blockchain projects have modified their emissions curves recently, including Ethereum which is ranked 2nd in terms of marketcap value. It is believed that these modifications have been made to become more comparable with Bitcoin’s dilution rates. Bitcoin being the first cryptocurrency, has had many years a headstart on other projects, and it has reached the tail end of it’s emission curve. It can be argued that Bismuth must modify its emissions curve too, or be left behind.

Many more arguments and discussions can be found on the discord, #trade channel.